change in working capital formula fcff

Difference Between Working Capital and Change in Working Capital Lets start with the definition of working capital again. Then you will need to multiply the interest by one minus the tax rate.

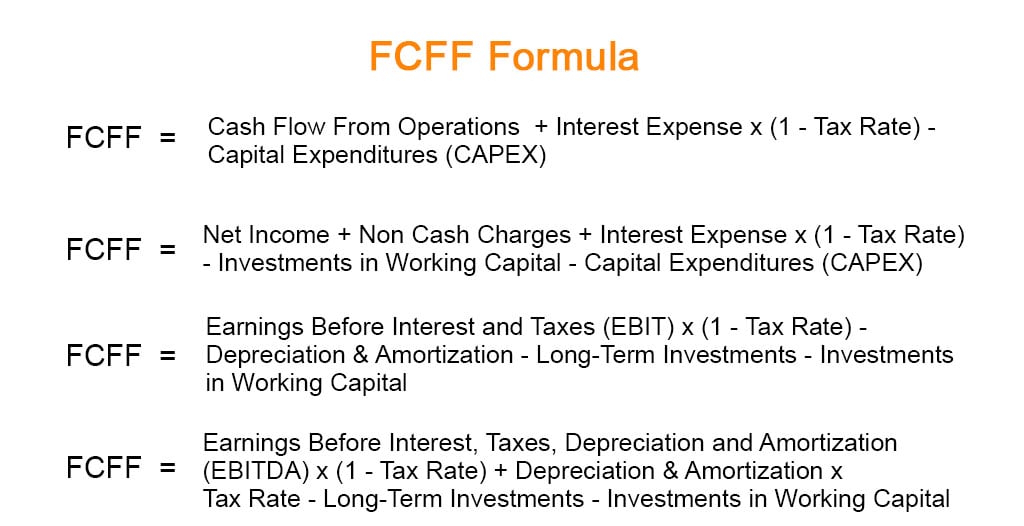

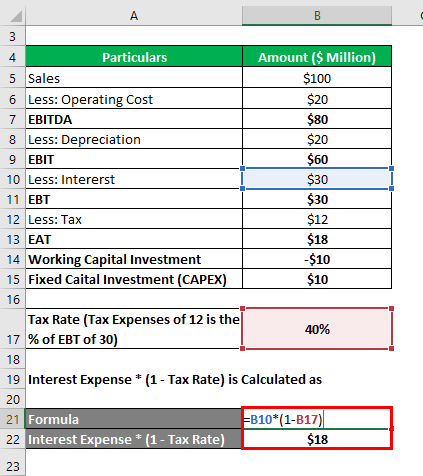

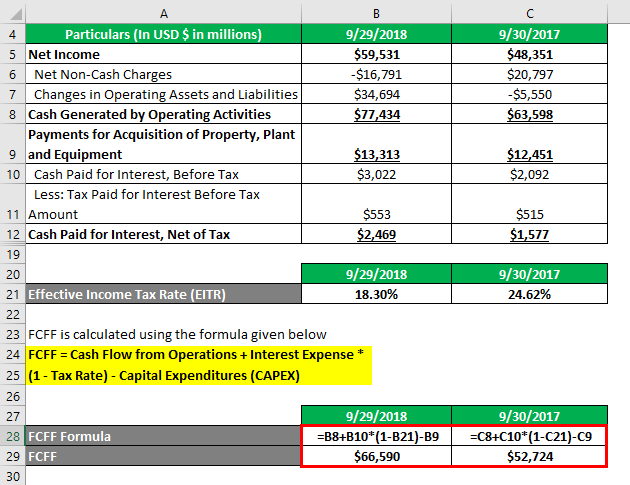

Fcff Formula Examples Of Fcff With Excel Template

The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate 1-t.

. This will give you the final free cash flow to the firm. Change in working capital investment current assets cash and cash. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant.

Some of the cash has to go back into the business to renew fixed assets and support working capital. Working Capital Current Assets - Current Liabilities Working capital is a balance sheet definition which only gives. Since the change in working capital is positive you add it back to Free Cash Flow.

To calculate the formula above you will need to add the Net income and Non-cash charges. Working capital increases. Variables of the FCFF Formula.

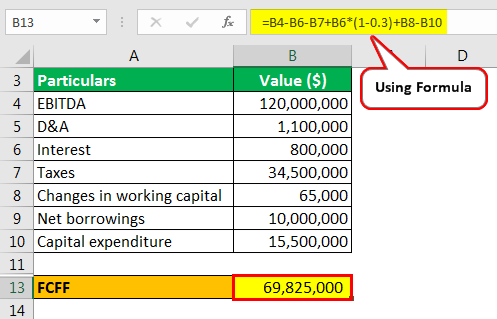

FCFEBIT1-t Depreciation Amortisation - CAPEX - Net Working Capital. Change in Net Working Capital NWC Prior Period NWC Current Period NWC As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. Free Cash Flow For The Firm - FCFF.

Then subtract the long-term investments and investments in working capital. Increasing vs Decreasing Change in NWC. Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a firm after expenses.

FCFF Net Income Depreciation Amortization CapEx ΔWorking Capital Interest Expense 1 t Where. Check out our trade and receivables financing options. Free cash flow decreases.

Discounted free cash flow for the firm FCFF should be equal to all of the cash inflows and outflows adjusted to present value by an appropriate interest rate that the firm can be. Free Cash Flow to Firm FCFF Cashflows from operations CFO Cashflows from Investments CFI A business generates cash through its daily operations of supplying and selling goods or services. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Change In Net Working Capital Nwc Formula And Calculator Excel Template

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcff Formula Examples Of Fcff With Excel Template

Change In Working Capital Video Tutorial W Excel Download

Unlevered Free Cash Flow Definition Examples Formula

Fcff Formula Examples Of Fcff With Excel Template

Free Cash Flow Meaning Examples What Is Fcf In Valuation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Changes In Net Working Capital All You Need To Know

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Efinancemanagement

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Change In Net Working Capital Nwc Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow To Firm Fcff Formula And Calculator Excel Template